When Surfside, Florida’s Champlain Towers collapsed in 2021, in a horrifying middle-of-the-night disaster that killed 98 residents, early reports focused on the problem of a volunteer board failing to act quickly enough to raise assessments and repair an aging building.

The 126-unit condo, built in 1981, had undergone two inspections. In 2018, the consulting engineer warned of “major structural damage.” According to the New York Times, the report estimated that the repairs would cost more than $9 million. The same engineer performed a second study in 2021. By then, the problems had grown worse. It appears that neither study predicted catastrophic failure.

Just before the collapse, the board passed a special assessment of $15 million to make urgent structural repairs. (Unlike California law, Florida law does not impose a requirement for homeowner approval for special assessments for repair of the common elements, regardless of dollar amount.)

In retrospect, even that amount of money would not have saved the building. In a forensic engineering analysis published in 2025, the primary cause of the collapse turned out to be construction defects dating back 40 years.

New Florida Laws

The Florida legislature reacted to the Champlain Towers tragedy by passing new laws in 2022 and 2023 requiring a Structural Integrity Reserve Study (SIRS) for many types of buildings.

Florida’s SIRS is performed every ten years and focuses on structural elements. If properly implemented, it’s an improvement over California’s every-three-years reserve study, which, as noted in a previous CondoWonk article, can miss important repairs while being cluttered with extraneous items.

However, Florida’s new laws also required full funding of reserves for items listed in those SIRS inspection reports, causing both regular assessments (dues) and special assessments to skyrocket.

Predictably, the next thing to collapse was Florida’s condominium market. With dues rising to satisfy the reserve requirements, combined with an insurance crisis, many owners were priced out of their homes but unable to find buyers.

Dialing Back a Bit

The legislature realized it had gone too far. In 2025, new legislation made significant revisions to help condo associations:

- Although the SIRS could list additional items, mandatory reserve funding applied only to repairs needed for its structural integrity.

- After completing a SIRS, owners can vote to pause mandatory reserves for two years and use that money to make repairs.

- Rather than raising dues, an HOA may, with owner approval, fund the required reserve items with a special assessment, bank loan or line of credit.

Even with the 2025 amendments, though, Florida law still requires funding of reserves 25 years into the future.

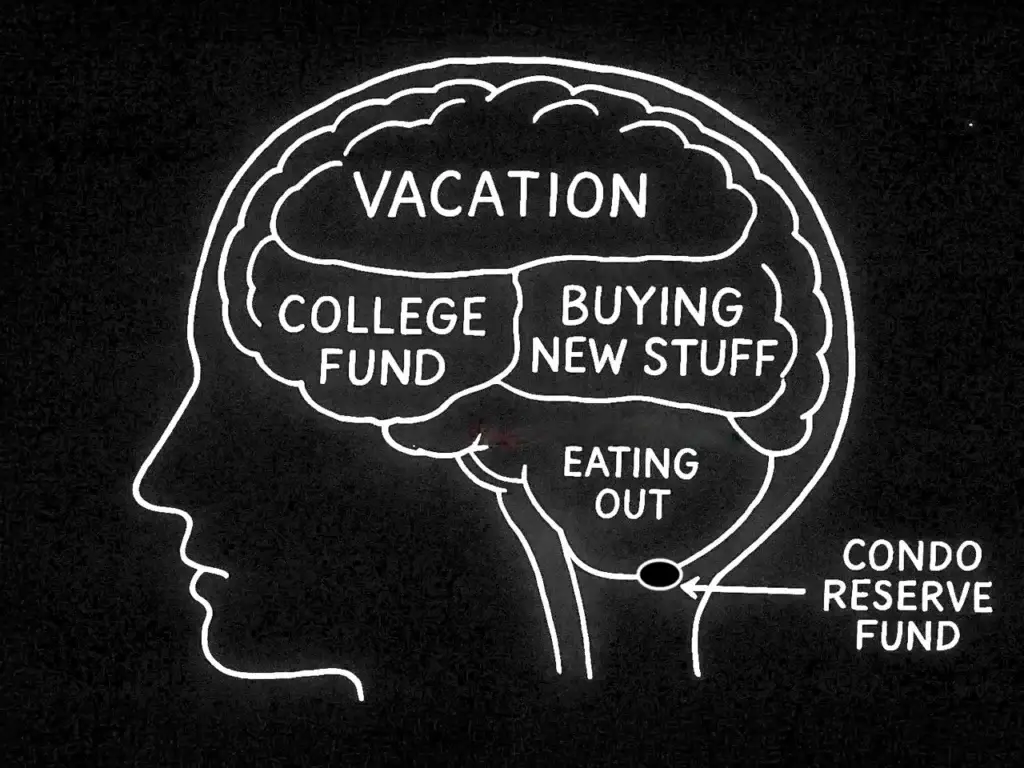

As previously discussed in CondoWonk, formulas for long-term funding of reserves go against everything we know about human nature. People have a hard time saving for their future selves, much less for someone who may own the unit decades from now. Worse, with the requirement for safe investments and federal taxation of the interest on reserves, reserves can’t even keep up with inflation.

Would It Have Prevented the Tragedy?

Had they existed earlier, would Florida’s SIRS inspection and reserve funding requirement have prevented the loss of life that night at Champlain Towers?

Miami-Dade already had a requirement that most buildings undergo inspection at the 40-year mark. Both the 2018 and the 2021 engineering studies were done in anticipation of that inspection. Both reports gave the board troubling findings but apparently did not reveal the magnitude of the danger to residents.

By the time of the collapse, no amount of reserves could have fixed the fatal flaws that began with poor construction 40 years prior.

What Champlain Towers Taught Us

Neither the inspection nor the special assessment saved Champlain Towers.

But the fact that the building did collapse changed the future. It taught everyone that condo buildings can come down, taking with it the people who live there.

The real lesson of Champlain Towers is the awareness that buildings can collapse, and that acting in time can save lives.

That knowledge may have already saved lives.

Same Issue, Different Outcome

In contrast to national headlines surrounding the Champlain Towers collapse, the quiet evacuation and planned demolition of the Riverview condominium in Cambridge, MA, was not widely reported outside the Boston area.

In 2024, engineers discovered structural flaws in the building during roof repairs. According to the Harvard Crimson,

The building was designed as rental housing in the early 1960s using substandard concrete, improperly reinforced with steel rebar. Though the building transitioned to luxury condos in 1972, the structural hazards went undiscovered for nearly 60 years.

The condominium board determined the 80-unit building to be unsafe and ordered its evacuation in November of 2024, before snow could add an additional burden.

Although the condo association originally hoped that the building could be repaired and the residents would be able to return, repair costs were estimated at close to $80 million and, due to the structural issues, would have put workers at unacceptable risk. Demolition was the only option.

The condominium board partnered with the City of Cambridge to arrange Riverview’s safe demolition. The demolition began in December, 2025, and is expected to take several months to complete.

What’s Needed Now

Condominiums are believed to represent about nine percent of all housing units in California and are the most affordable path to home ownership. That housing stock is rapidly aging, with most built before 1990.

Buildings that are in danger of collapse need to be identified and demolished safely, before lives are lost. But those buildings are rare.

Many more condo buildings are undergoing normal aging and are at risk of gradually become uninhabitable as volunteer boards—set up to fail—struggle to understand their buildings’ needs and raise money from their members.

We need to pay attention, before the quiet disappearance of these buildings takes away critical affordable housing.

Boards need help, not punitive measures, to evaluate their buildings’ condition and raise the money to take care of them now, before they need ever more costly repairs.

In future installments, CondoWonk will look at public policy solutions, including potential legislation, and we’ll find out what this means for HOAs.

Final Thoughts: Champlain Towers

Immediately before the collapse, the 126 units in Champlain Towers had a combined value appraised at $95 million.

DAMAC Properties, a Dubai-based luxury real estate developer, purchased the empty two-acre parcel in Surfside for $120 million and has begun construction on an “ultra-luxury” project of 37 units.

The $15 million starting price for a single unit in the new development is equal to the amount of the special assessment the Champlain Towers board imposed on its owners just before the collapse.

A memorial for the 98 victims is being designed for a site across from where the towers once stood.