Even over the phone, I could sense her shrugged shoulders. “You can’t compare buildings,” our then-manager said. “Each building is different.”

I had asked her if our building’s expenses were in line with other buildings. Buildings cost what they cost, she said.

It seemed like a lazy answer.

Soon after, I became friends with someone in the building next door. In many ways, our buildings seemed similar. Both were built in the 1980s, with massive underground garage structures. My neighbor’s building has 30 units, ours has 26. Units sell for similar prices.

But my neighbor’s monthly assessments—what most people call “dues”—were about 25% less than ours, and their reserves were much better funded. I wanted to know why.

We traded budgets and I dug in.

Comparing Numbers. Some of it was easy to figure out. The difference between 26 units and 30 units doesn’t seem like much, but it means that fixed costs, like the elevator, were divided into more shares in my neighbor’s building.

Insurance is one of the biggest parts of any HOA’s budget. Our insurance costs are high because our units are exceptionally large, increasing our insured replacement value. We also carry “walls in coverage” as required by our CC&Rs, while our neighbor does not. As a result, their insured value and premiums per unit were somewhat lower next door.

Utility costs, however, were radically different. Utilities are more than a third of our budget. Our neighbor’s costs were about half of ours in every category on a per-unit basis. How was this possible? What would we have to do to make our bills comparable with theirs?

Finding Real Savings. Trash collection jumped out as the first place to save money. Our numbers seemed way out of line.

In telephone conversations with our waste collection service, I learned that collection fees are based primarily on the number of weekly collections…and we were getting trash pick-up four times a week. Why? No one knew. Cutting back to twice a week saved almost half of what we were paying for waste collection, putting us in line with our thrifty neighbor. Same amount of trash, just fewer times the bin got rolled to the street and emptied.

It took some time to learn tricks for reducing our electric bill, including LED lighting and learning the secret rate for condominium common areas, but our bills are now similar to our neighbor. (They didn’t know about the secret rate, either, but they do have fewer areas to light.)

We also saved some money on telephone service for our front entry system and elevator, and internet for our security system. Unlike with utility companies, you can negotiate with internet providers. Or find another one. We also made some changes in our vendors, mostly for better service but also realizing some small cost savings.

Those were the successes. Some savings still seem out of reach.

Reaching Limits. Our gas prices are double theirs. Both buildings have boilers to supply hot water to all the units, but our pool is indoors and heated all year around; theirs is outdoors and only heated part of the year. We experimented with changing the pool temperature—more on that in a later post—and we try to maintain our boiler to make it as efficient as possible, but we probably won’t see real savings until we replace our boiler with more efficient technology in a few years.

Our neighbor’s water usage is significantly less. Like us, they supply water to all their units. We are requiring owners to get rid of inefficient plumbing fixtures but I’m still figuring this one out.

End Results. Comparing our budget with our neighbor’s was a useful exercise. We didn’t know we had been overpaying for trash and electric. Fixing it saved around 7% of our budget. It’s real money and it helps.

Ultimately, though, there are structural reasons why our assessments are more and our neighbors’ are less. Despite some superficial similarities, our side-by-side buildings are quite different.

It’s budget time now, and even with all our cost trimming, our assessments will still be significantly higher than our neighbor’s.

So was our former manager right after all? Adjusted for inflation, do buildings have an immutable “set point” that you can’t get away from, no matter how hard you try to economize? Are budgets pretty much pre-determined?

Learning from the Condo Triplets. It turns out there are better buildings with which to compare our budget than the one next door.

On Redfin, I stalk two buildings in our neighborhood that were built from plans drawn by the same architect who designed ours. Like ours, they have oversized units and high ceilings. Their distinctive floor plans, with the large bedroom skewed on a diagonal, are almost identical to ours. Online, their recreational areas look just like ours: basement pools and spas with identical tile, even the same saunas. Both were built in the 1980s within a couple of years of ours and are presumably facing the same aging process.

And their assessments look very much like ours, at least according to Redfin. Condo triplets, separated at birth and running independent lives, have ended up at almost identical budget points.

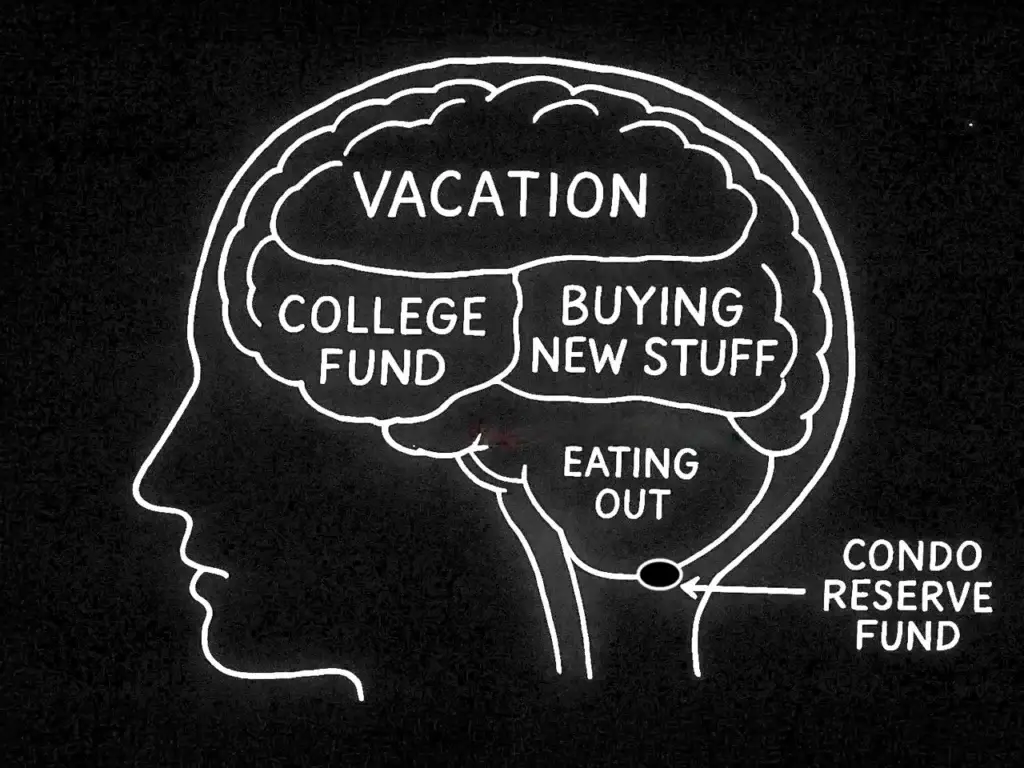

At our budget meeting, two board members complain that dues are too high, that some people will have a hard time paying. In the end, though, we agree to raise assessments. We are required by law to set our fees at the level necessary to take care of the building.

It is possible to trim a budget, and it’s worth finding ways to avoid wasting money. But in the end, I think our prior manager was mostly right. Buildings cost what they cost.