You may be dazzled by the perfect unit, but you need to take a hard look at the whole building. Chances are that underneath that gorgeously remodeled kitchen and hardwood floors, everything is old.

According to my research—manipulating Zillow search terms—two-thirds of all condominium units for sale in LA County are built in 1990 or earlier. More than half of all units were built by 1980.

Here are some things to help you choose a condo in Los Angeles, particularly in an older building.

1. Buildings get more expensive as they age.

Leaks happen. Roofs need to be replaced periodically, as do, eventually, windows and doors. (In some buildings, windows and doors are the unit owner’s responsibility. In others, it’s the HOA.) When the water starts coming through the walls, more extensive repairs may be coming.

Old plumbing may also cause leaks. When it happens too often, replumbing the building may be needed.

2. HOA dues are not a guarantee.

Monthly assessments (commonly known as HOA dues) are one indicator of what it will cost to own a condominium. But it’s a floor, not a ceiling. Plenty of unexpected extras can be added on.

Low monthly fees may be appealing. However, really low fees may mean that the board is not properly maintaining the building or is skimping on reserves, or both.

Boards are required by law to set dues high enough to cover necessary expenses. Unless there are very well-funded reserves, dues will go up, or there will be special assessments to cover an unexpected cost.

Much of the budget, including big increases in insurance, utilities and trash or recycling fees, is completely outside the board’s control.

3. HOA dues might cover a lot. Or not.

You can’t compare HOA dues from one building to another unless you know what it includes.

Insurance, discussed below, is probably the largest line item in any HOA’s budget.

Some costs are obvious. A building with a pool will cost more to maintain than one without. Even more if it’s heated. An elevator adds a little to the budget. On-site management or front-desk adds a lot.

Other costs—or savings, depending on how you look at it—are hidden. For instance, some buildings have a central water system and boiler that delivers hot and cold running water to every unit. The $100 or so it adds to the monthly dues might make a building look more expensive, but it replaces the separate water bill that unit owners would get otherwise, plus the cost of maintaining a water heater in the unit and paying for its gas or electricity.

4. Insurance coverage varies greatly from one building to another.

There is no standard kind of insurance HOAs must carry. Instead, each board decides about insurance, based to a large extent upon what their CC&Rs require. Those requirements, written into the documents when the building was built, differ greatly from one property to another, so you need to understand what type of insurance coverage is provided in your HOA dues.

- Often, an HOA’s master policy insures the building structure but nothing inside the units. You will need an additional policy known as an HO-6 policy to cover your cabinets, appliances, fixtures, flooring and everything else in your unit.

- Some CC&Rs, particularly in older buildings, require “walls in” coverage. That means the HOA master policy covers everything in the building, including your unit’s fancy new cabinets and hardwood floors. Walls-in coverage, as it’s called, adds to the HOA dues but you can greatly reduce your HO-6 policy so that you don’t duplicate coverage.

- Some townhouses may rely on unit owners to insure their entire townhouse building rather than have master coverage.

Check out the size of the deductible, too. Even if the HOA insurance covers damage to your unit, you may be responsible for covering the deductible. If the deductible is large, your HO-6 policy can be designed to pick up the difference.

5. Some buildings carry earthquake insurance. Most don’t.

Regular insurance doesn’t cover earthquake damage, so owners without HOA earthquake coverage may lose the entire value of their unit if the Big One hits. Even if there is earthquake coverage, it may have a very high deductible. Most buildings do not have earthquake insurance. For those that do, it may add $100 a month or more on the unit owner’s dues.

6. The elevator might need an overhaul.

Buildings from the 1980s or earlier were commonly built with relay controls rather than newer solid-state systems. If the elevator has the original mechanical relays, it’s likely to break down a lot, causing service interruptions.

It’s also living on borrowed time. Elevators with relay controls are now considered obsolete, meaning parts are no longer manufactured. Companies that service them are running out of spare parts. At some point, that elevator can no longer be repaired.

A scheduled overhaul can bring the entire mechanism up to today’s standards and vastly improve its reliability, but it’s expensive and it takes the elevator out of service for at least six weeks. (If the HOA waits until the elevator breaks down to perform an overhaul, it may be out for months while the vendor gets parts and schedules a crew.)

If having an reliable elevator is essential, look for an elevator that has already been overhauled, or a building with two elevators. Or a newer building.

Don’t count on the appearance of the cab, which may have cosmetic improvements without an upgrade to the working mechanism.

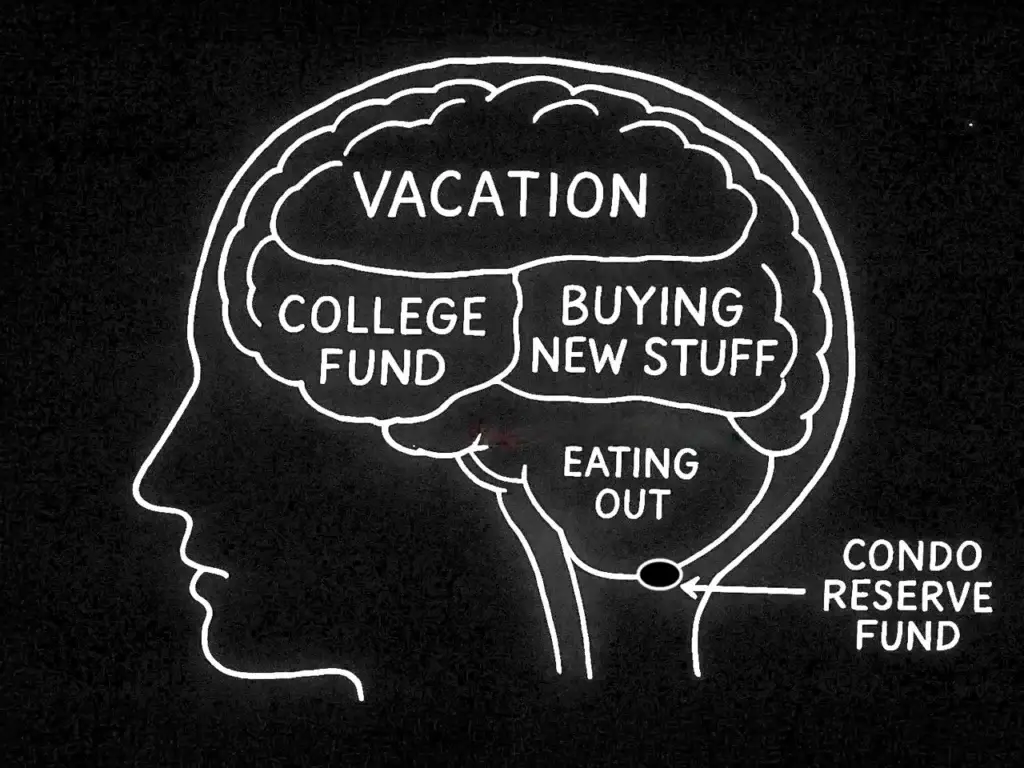

7. Reserve funds are rarely enough.

Banks like to see condos dedicate at least 10% of their budget to building up their reserve funds. A condo that doesn’t have that much listed in their budget for reserves will be hard to finance.

Here’s the problem: Ten percent isn’t enough. In reality, if the budget is tight, even that ten percent will be eaten up with regular expenses and never make it into reserves.

For the rare building that has generous reserves, are they spending it when appropriate, or are they neglecting necessary maintenance?

Many buildings have a history of special assessing for major expenses. The homeowners understand they will have to pony up when the time comes, but they’d rather invest their money themselves until then. You’ll need to ask about the frequency and size of special assessments to understand if that approach works for you.

8. A good building is one that is well maintained.

While healthy reserves are definitely better than very low reserves, a particular condo may still be a good choice if it has a good board and good management and believes in doing preventative maintenance.

Every buyer is entitled by statute to request the last 12 months’ minutes as well as the annual financial statement. They will tell you a lot about what the building’s various maintenance issues are and how the board responds. Follow up on any questions with a conversation with the president.

9. Yes, you can plug in your car, but it will cost you.

The law requires HOAs to figure out how to let owners charge their cars, but it’s complicated, particularly in older buildings that were never designed for electric vehicles. See more here.

10. There are good things to know about condos, too.

Condos are more likely to be located in walkable neighborhoods, near restaurants, retail and transit.

In Los Angeles’ impossible housing crisis, condos are a foot in the door. They will probably give you more interior space for your money than a single-family home.

Also, the stock of single-family houses in Los Angeles County is even older.