Nobody knows what percentage of condominium associations in Los Angeles, or the state of California, carry earthquake insurance.

“The information you are seeking does not exist.” That’s what the representative from the California Department of Insurance told me when I asked.

In fact, he said it again for emphasis: “Nobody has those statistics. The information you are seeking does not exist.”

For our HOA, it’s a $28,000 question

That’s how much we budgeted this year for earthquake insurance—ten percent of our annual budget. It comes out to $90 per month for each homeowner in our 26-unit building.

Then the bills came in for the renewal, and the inevitable premium increases. We decided to raise the deductible from 15% to 20%—the only two options available to most condominiums in California. With the 20% deductible, the HOA pays an annual premium for earthquake coverage of $23,314. That’s $75 per unit per month.

But with either deductible, we probably won’t have meaningful coverage if we are hit by an earthquake.

How Earthquake Deductibles Work

Our building’s general liability policy currently has a deductible of $5,000. If we have a fire or water damage, we are well insured.

Earthquake insurance deductibles work differently. Instead of a fixed amount, they are calculated as a percentage of the policy loss limit. The policy loss limit is based on the value of the building, minus the value of the land and other exclusions.

Having a large insured value may sound like a good thing. However, as rising property values inflate the policy loss limit, the amount of the deductible rises with it.

Our current policy loss limit is $14.23 million. At our current insured value, our 20% deductible equals $2.85 million. We have no coverage for damage that is less than that amount. None.

In the event of a major loss, that cost would need to be shared among all homeowners. That means our 26 units would each face a special assessment of almost $110,000 to pay the deductible, before any earthquake insurance coverage would apply. For damage that was less than $2.85 million, unit owners would pay the entire cost.

Some buildings are more vulnerable than others

Certain building types are known to be far more susceptible to serious damage in a quake. Our building is not of any of the known vulnerable types.

The California Department of Conservation has an Earthquake Hazards Zone Map that indicates, at the street address level, whether a parcel is within an Earthquake Fault Zone, a Liquefication Zone or a Landslide Zone. Ours is in none of those higher risk levels.

Is It Worth it?

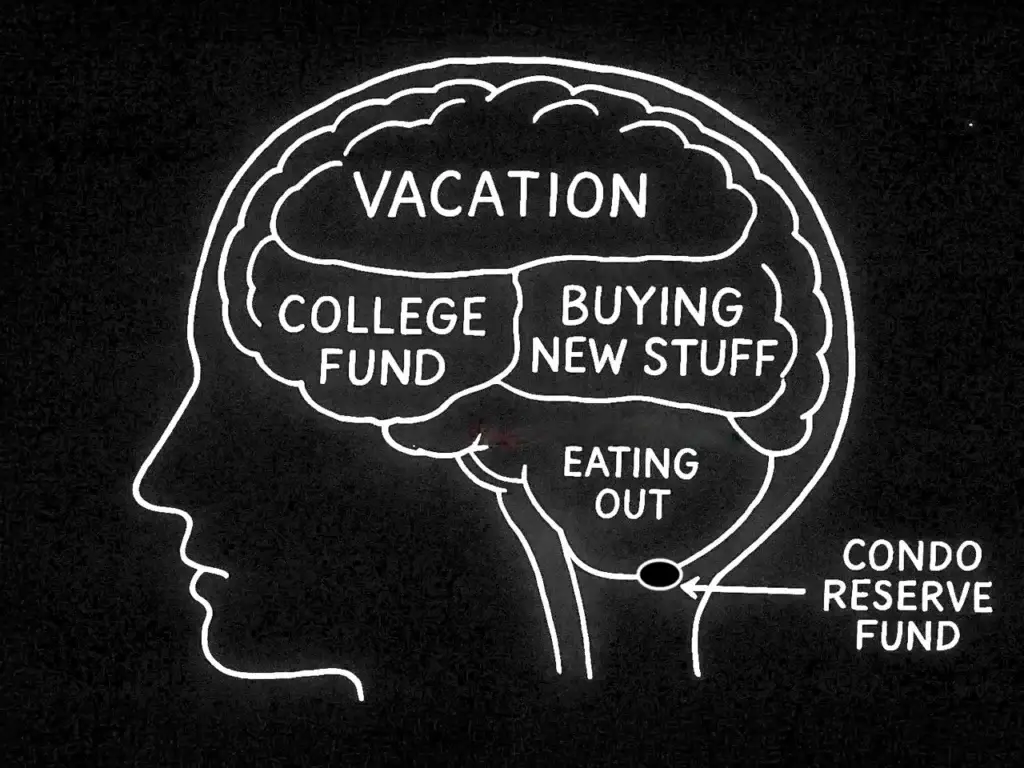

We scrutinized every line item on our sprawling budget. And we really started to question whether earthquake insurance was worth it.

Not that we were in a hurry to do that. Our building had always carried it. We were, in fact, a bit smug about it: our dues are higher because we carry earthquake insurance.

But still: was this a reasonable use of our HOA funds?

Could a case be made that the board would be acting moreprudently by dropping the coverage and putting the money into our reserves? Or into structural improvements meant to reduce damage in the event of an earthquake?

As FEMA states,

If impacted by an earthquake, most homes would experience damage that does not exceed their insurance deductibles, meaning that even with insurance’s high rates, insured homeowners would not receive money from their policy to address the damage.

Considering all that, the Board began to think about dropping the coverage.

But that may not be possible.

What our CC&Rs require

Our CC&Rs, recorded in 1986, requires that our homeowners’ association (HOA) carry an earthquake damage endorsement “as is customarily obtained in connection with projects similar in construction, location and use to the Project…”

It was my impression that the number of HOAs in Los Angeles that carry earthquake insurance is low, maybe about a third or less. So our CC&Rs say we don’t need to buy earthquake insurance, right?

No statistics, anywhere

That led me to my inquiry to the California Department of Insurance asking for statistics about the percentage of condominium buildings that carry the coverage. And the official’s flat statement that there is no data base with that information.

FEMA states on its website that only 10% of California’s residents have earthquake insurance—despite the state having 90% of the country’s earthquakes. It does not provide additional information about condominium associations or provide statistics specifically for Los Angeles. (I asked.)

The Surplus Line Association of California, which represents companies that write earthquake insurance, also said that they had no data. The California Earthquake Authority did not respond to my inquiry.

What does Zillow say

With government agencies not providing any data, I turned to what’s possibly the largest free market real estate data base out there: Zillow.

I asked Zillow how many condominium units are for sale in various Los Angeles neighborhoods, selecting for buildings built between 1970 and 2000 in our building’s general unit price range. Then—because listings for buildings that carry earthquake insurance almost invariably advertise that fact—I asked Zillow how many of those listings mentioned the word “earthquake.”

For Brentwood (our neighborhood) and nearby Santa Monica, the rate of listings that mention the word “earthquake” was 36%. For all of Los Angeles, it was 25%.

The Conundrum

Our manager says about a third of his buildings carry earthquake insurance, supporting the Zillow research.

But our attorney has an opposite impression of how many associations carry earthquake insurance. He thinks almost everyone does.

And even if we could prove definitively that only a minority of condo buildings in our neighborhood carry earthquake insurance, how do we prove that these buildings are “similar in construction, location and use” to ours?

Without official statistics, the stakes are high. If we cancel our earthquake insurance and have a major quake, the board could be sued for failure to insure.

A More Useful Type of Earthquake Insurance

There is a second type of earthquake insurance that condo unit owners can purchase that might end up being more useful than the HOA policy. Earthquake damage is not included in unit owner’s policies, known commonly as an HO6, but is available as a separate policy.

In addition to covering damage to personal property from an earthquake and the cost of temporary living space, unit owner earthquake coverage can be written to include up to $100,000 of “loss assessment” coverage to pay HOA special assessments. This type of insurance can reimburse homeowners for the special assessments needed for the HOA to repair damage not covered under its own policy.

In the case of a major loss, $100,000 of loss assessment coverage would pay almost all the special assessment for damage to cover the deductible on our earthquake insurance. For damage that was less than the amount of the deductible, a loss assessment rider is likely to completely cover emergency HOA assessments.

This kind of coverage could make it far easier for the HOA to collect the assessments it needs to repair damage after an earthquake, including damage that is less than the deductible on the HOA policy.

Making Decisions

For us, it appears that if we want to cancel our earthquake insurance, we probably should amend our CC&Rs. That takes approval of 75% of the homeowners, so we are stuck with paying for earthquake insurance, at least for now. I suspect many HOAs that carry earthquake insurance are also compelled by their CC&Rs.

For HOAs who don’t have mandatory language in their CC&Rs, the decision whether to carry earthquake insurance is based on risk tolerance. Some owners may need to protect their equity. Others are highly leveraged and willing to walk away. Adding to the difficulty: the extremely high cost of the insurance, the uncertainty of when or if an earthquake will damage your building and the very real possibility that you could have significant damage and still not meet the deductible.

Final Thoughts

This article is an introduction to earthquake insurance, the difficulty of the cost/benefit analysis and the very real limitations of its coverage.

What is even murkier is what happens after a major quake. How do you get bids to repair damage—crucial to the decision whether to rebuild—when every contractor is overwhelmed? What happens if owners haven’t purchased personal loss assessment coverage and can’t pay special assessments? If some or all of your building is uninhabitable, how do you even keep in contact with homeowners to make necessary decisions?

Much is unknowable until it happens, and then it will be a mess.

In the meantime, check your CC&Rs. What do your documents say about how your HOA makes decisions in the aftermath of a quake? Older documents may have no provisions. Some have provisions that are ill-suited for the reality of earthquake insurance deductibles.

Whether or not you have earthquake insurance, amending your documents now to have solid emergency procedures in place may be the most cost-effective thing you can do.